The FuBus Group (FuBus for short), also known as Infinus in the media, was an association of various companies (Future Business KGaA, Prosavus AG, ecoConsort AG) in the financial services sector.

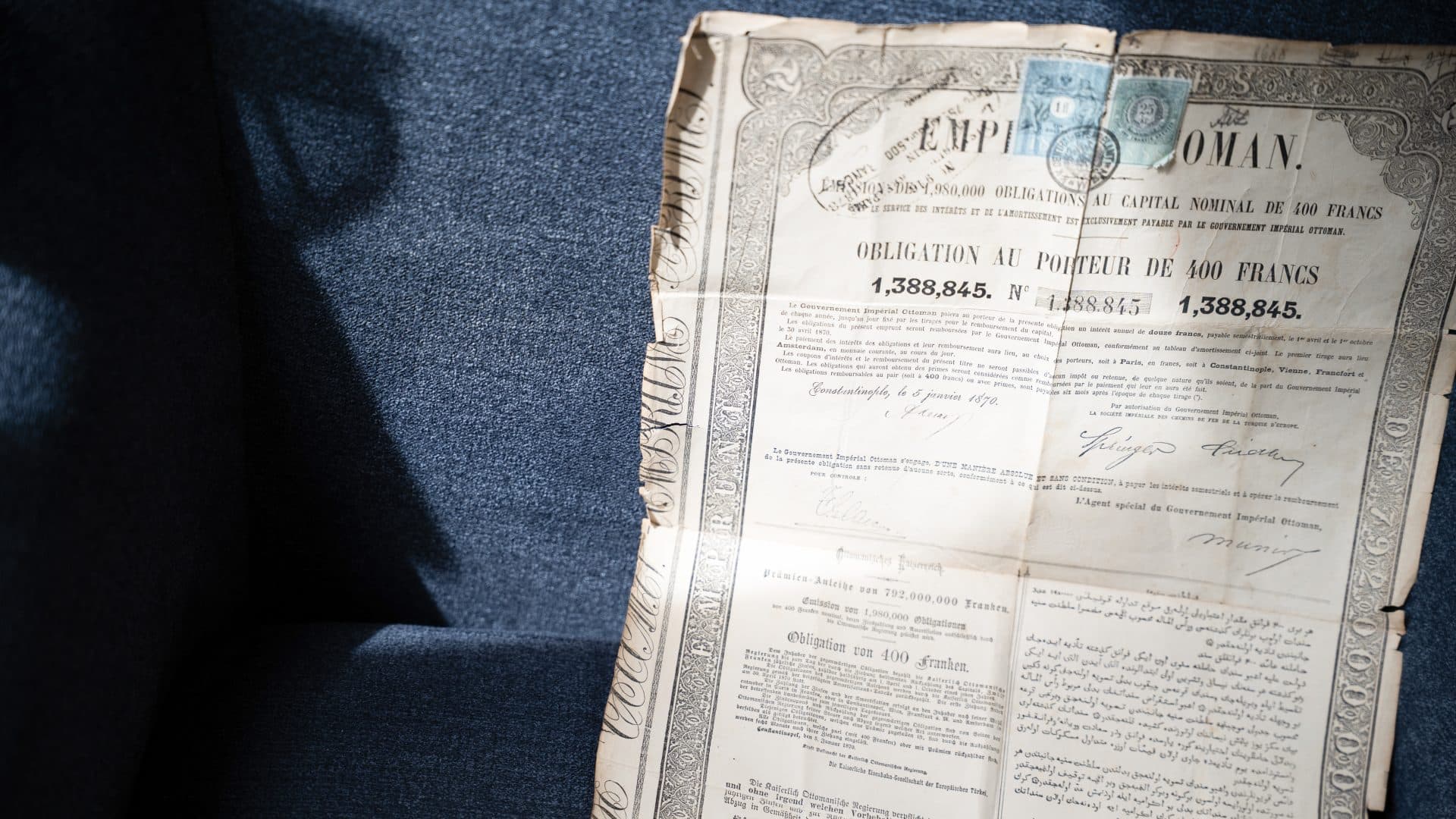

The group was founded in the early 90s as an intermediary for life insurance. In the late 90s, FuBus began acquiring existing capital life insurance policies (“secondary market policies”). The capital required for this was mostly financed through the issuance of order bonds, with interest rates between 4.5% and 9%.

From 2008, the secondary market policy business no longer functioned – new life insurance policies were concluded as proprietary contracts with Fubus as the policyholder (so-called proprietary contracts). The commissions for these life insurance policies were fraudulently presented as revenue. From 2009, these proprietary transactions accounted for an incredible 96% of the business, with only 4% attributable to brokering policies for third parties.

The main product partner for the proprietary transactions since 2006 was Finance-Life, accounting for over 50% of the business. Finance-Life concluded individual policies with an insurance volume of 3 to 4 billion EUR.

Without these proprietary contracts, FuBus would have been operating at a deficit from 2008 at the latest and would have had to file for insolvency. However, by maintaining this “pyramid-scheme-like” / “fraudulent” system, FuBus, along with its companies Future Business KGaA, Prosavus AG, and ecoConsort AG, managed to issue, in addition to order bonds, participation rights, subordinated loans, and shares until 2013, which caused many investors to suffer losses. It was one of the largest pyramid schemes in Germany in recent decades (Infinus scandal).

In criminal proceedings before the Dresden Regional Court, five FuBus managers were sentenced in July 2018, among other things for fraud, to lengthy prison sentences (not yet legally binding).

From 2009 at the latest, the Austrian UNIQA, as the then (in)direct 100% shareholder of Finance-Life, examined the plausibility of the business model and, in internal memos, drew the attention of the UNIQA board to possible risks, including the possibility of a pyramid-scheme-like system. Nevertheless, UNIQA continued to distribute its policies until mid-2011, thereby contributing to the continuation of the fraudulent activities of the FuBus managers. The system ended with the insolvency of FuBus in November 2013.